How Much Is Hulu Worth?

When Disney purchased 20th Century Fox back in 2019, it obtained a majority stake in Hulu, resulting in an agreement with Comcast that saw Disney assuming full operational control of Hulu, effective immediately, in return for Disney and Comcast entering into a “put/call” agreement regarding NBCUniversal’s 33% ownership interest in Hulu.

This initial put/call agreement, was set to take place as early as January 2024, but that has now been pulled forward to the end of September. This agreement allows Comcast to force Disney to buy NBCUniversal’s interest in Hulu or allow Disney to force NBCUniversal to sell that interest to Disney for its fair market value that independent experts will assess, but Disney has guaranteed a sale price for Comcast that represents a minimum total equity value of Hulu at that time of $27.5 billion. There was also an agreement that saw Comcast’s stake in Hulu reduced if it didn’t maintain paying its share of Hulu’s cost (which it hasn’t been), down to a minimum stake of 21%.

Last month, it was revealed that talks have been going on between Comcast and Disney over the future of Hulu for a long time, but recently, in an SEC filing, that the two companies have been conducting a confidential arbitration concerning the parties’ rights and responsibilities under the Hulu limited liability company agreement. The Company expects a decision in that arbitration within the next quarter. The outcome of the arbitration is uncertain, and we cannot reasonably estimate the amount of any potential loss or the impact on the determination of the value of Hulu’s equity pursuant to the Hulu limited liability company agreement and thus, the amount we may be required to pay to acquire NBCU’s interest in Hulu.

One of the other major question marks about Disney’s purchase of Hulu is about how much this is going to cost. While Disney is hoping the value of Hulu is around the initial valuation of $27.5 billion, it is likely to be more, and Comcast will want as much money as they can. There will also likely be some disagreements on how much of Hulu Comcast owns, since they’ve not been investing in Hulu for years, but it can’t drop below a 21% share.

The valuation of Hulu is going to be a major issue, that will likely require a third party to value the platform, since it’s unlikely Comcast and Disney will agree on a number. Comcast’s CEO has been using any opportunity to talk about how the value of Hulu is huge, possibly double what was initially agreed, while Disney has been doing the exact opposite. Since the initial agreement was made, streaming services have gone through a huge boom during the pandemic, followed by a massive drop. Most of Hulu’s content is created by Disney’s studios, so if they took that off Hulu and moved it to Disney+, the value of Hulu would be massively reduced.

Recently, Business Insider, spoke to five different analysts about their valuations of Hulu, which varied slightly, but are generally all on the lower side, nearer the initial valuation, than maybe what Comcast would have liked.

- Tim Nollen, a Macquarie analyst with a neutral rating on Disney shares, currently estimates that Hulu is worth between $35.5 billion and $37.5 billion. This means Disney might be required to pay between $7.8 billion and $12 billion, depending on how much Comcast’s share is now worth.

- Matthew Thornton, a Truist analyst, also put Hulu’s worth at $34.3 billion, which could mean up to an $11 billion stake for Comcast based on a 33% stake.

- Barton Crockett, a Rosenblatt Securities analyst, has said that he puts Hulu at the low end of its valuation range, since Wall Street’s view of streaming services is much dimmer now than at the 2021 peak.

- Brandon Nispel, a KeyBanc Capital analyst, also values Hulu at $27.5 billion in his model. He views a $40 billion valuation would put Hulu at a premium to Netflix, which he sees as highly unlikely. He also believes that if a third-party evaluator is brought in, it’ll likely be more closer to Disney’s valuation.

- Jason Bazinet, a Citigroup analyst said Disney should swiftly negotiate a deal rather than going through a mediator since they might side with Comcast.

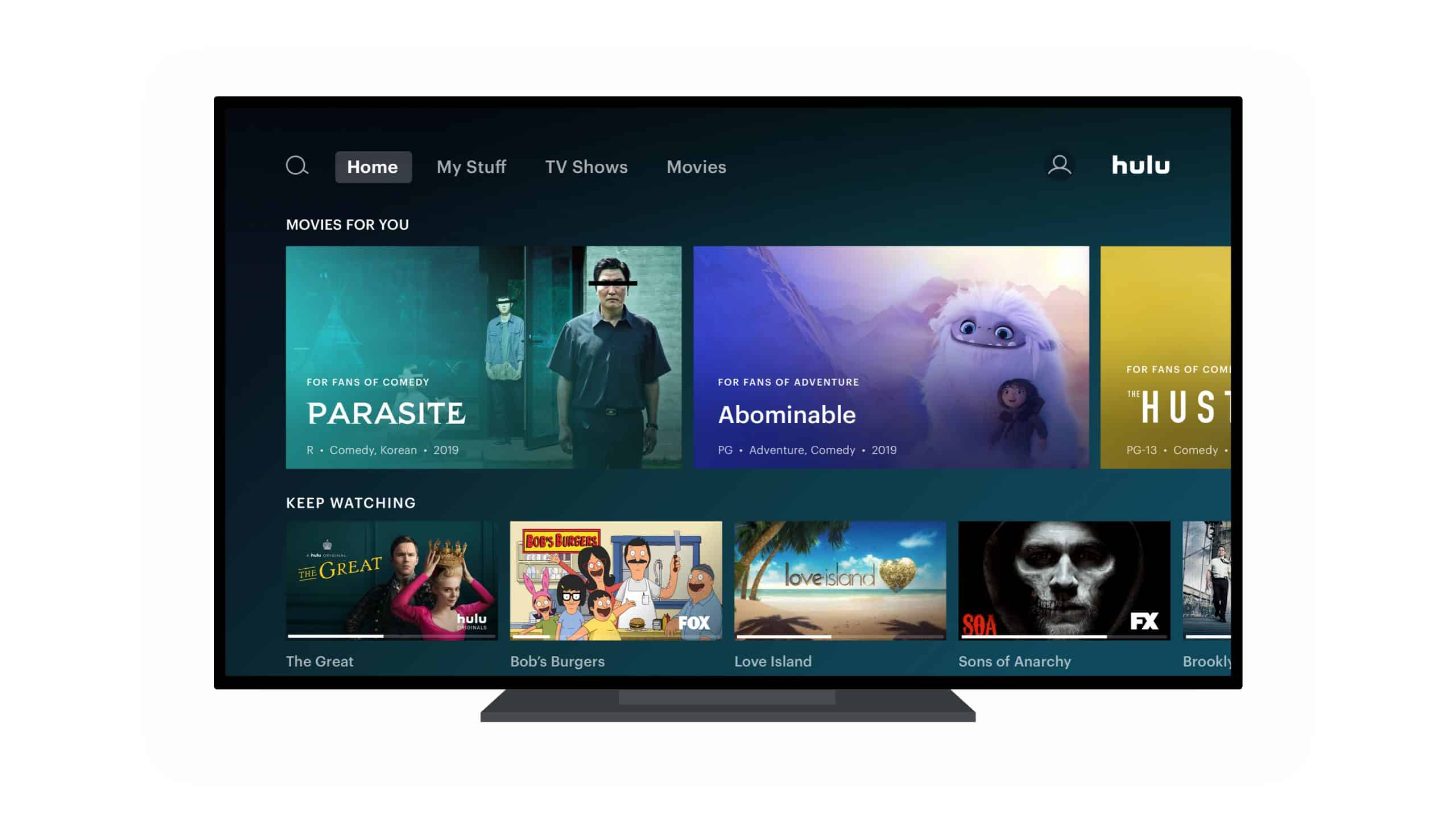

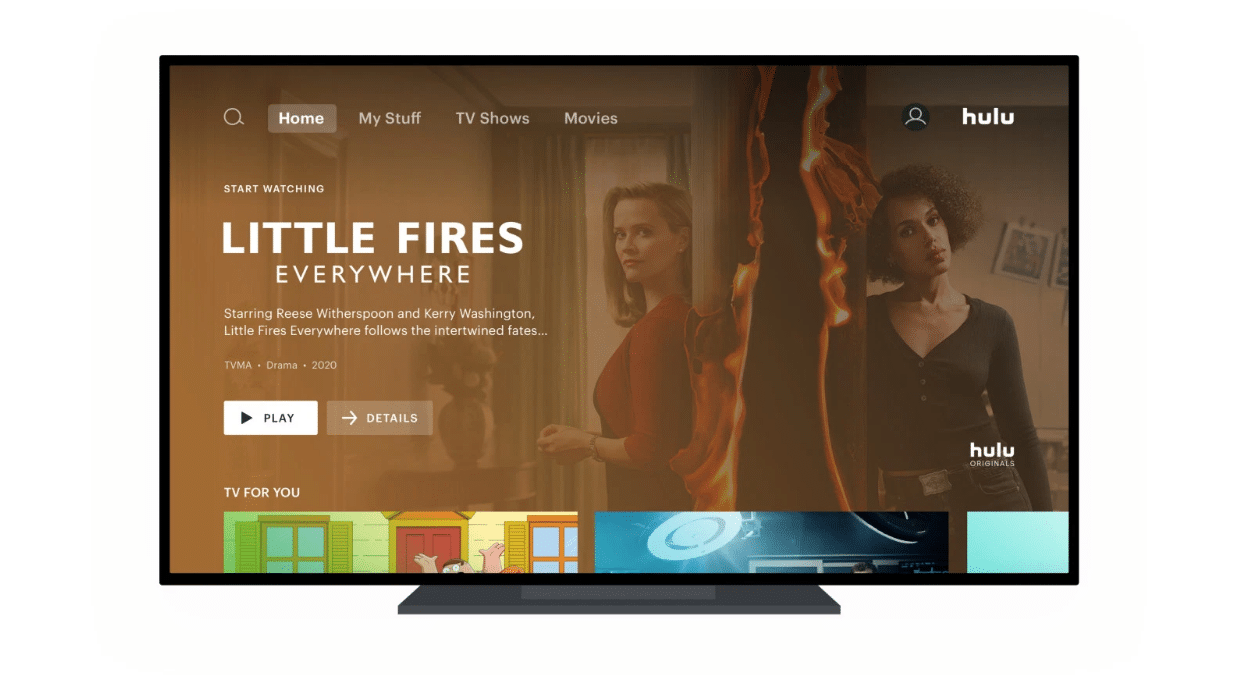

One of the main reasons Disney is keen to get the Hulu situation sorted, is because Disney CEO Bob Iger announced that they are planning on making Hulu content becoming available within Disney+ later this year as a part of a one-app experience. This ties in with the SEC filing and recent announcement that the put/call agreement is being triggered later this month. Internationally, most of the original Hulu content created by Disney’s studios is released on Disney+ and has already shown the value of a more varied offering of content.

The analysts also think that Disney+ needs more content, and the Hulu content will help beef up the streaming service. And the addition of Hulu’s advertising technology and knowledge is going to be a huge help in making Disney+ profitable.

With the put/call deadline coming to a close at the end of September, hopefully, we won’t have to wait too much longer for this long-winded situation to come to a close. Either way, at the minimum, Disney could be on the line to pay Comcast around $6 billion, but it’s likely to be somewhere much higher than that. Some may question if it’s a good idea for Disney to spend this money on Hulu, but ultimately, it doesn’t have much of a choice, because Comcast can force Disney to buy them out anyway, but at least moving forward, Disney can be focused on making Disney+ the best it can be, rather than splitting its content engine into two and become a legitimate contender to Netflix, Max and Prime!

What do you think Hulu will be valued at? Let us know on social media!