Disney’s Bob Iger Working To Get Streaming Technology At Netflix’s Level

At the Disney Investor Day in 2019, months before the launch of Disney+, executives revealed that they wouldn’t expect the streaming service to make a profit until 2024.

Since then, Disney has spent billions of dollars building up its streaming division, creating lots of original content like “The Mandalorian,” “Percy Jackson,” and “Loki.” But now, Disney is under pressure to ensure that Disney+ is profitable by the end of the year and has been making major changes to do so.

While Disney+ launched at a low price, there have been annual price rises each year, plus the introduction of the ad-supported tier. It will soon launch a campaign to reduce account sharing to increase new subscribers, following Netflix’s lead, which resulted in over twenty million subscribers being added and Warner Brothers Discovery also revealed they’ll be doing the same with their platform, Max, later this year too.

Disney has also been drastically cutting back on how many original shows and films it releases on the streaming platform, in an effort to reduce costs, but also as franchise fatigue has set in on brands like Marvel and Star Wars.

Recently, Disney CEO Bob Iger spoke at a question and answer session at the Morgan Stanley Technology, Media and Telecom Conference, where he was asked about making streaming, not just a profitable business, but a large growing and substantially profitable business over the long-term?

Well, the path begins with — I talked about restructuring earlier, but putting streaming under a completely new management structure. And in Alan Bergman and Dana Walden, we now have two Executives who are managing streaming globally. They also happen to manage all of our content creation on the TV and on the film side.

And that’s really important when it comes to streaming because obviously, streaming is a path to them monetizing what they make in a much more efficient, much more effective way. But it starts with that.

It also starts with really examining the cost structure. We took $7.5 billion of costs out of the company. Some of that came out of streaming. But we’ve also — we also believe we’re on pace to exceed the $7.5 billion, which will be a great thing, and that’s clearly having an impact on the bottom-line, but also when it comes to streaming, it’s a variety of different things.

When we launched Disney+ in 2019, our goal was to have basically robust video projection or video experiences at scale. And we needed that because we signed up 10 million subs in the first 24 hours, and we got to 100 million very fast. What we didn’t have was the technology that we needed to basically lower customer acquisition and retention costs to increase engagement to essentially grow our margins by reducing marketing expenses.

We’re now in the process of creating all and developing all of that technology. And obviously, the gold standard there is Netflix, we need to be at their level in terms of technology capability. And one of the reasons why their margins are so much more significant than ours is because they have that technology. So, our marketing expenses are significantly higher, our churn rates are higher than they need to be.

One of the biggest problems Disney+ has had in competing with Netflix, is that its been lacking all of Disney’s general entertainment content, as its all been stuck on Hulu in the US, but going through changes following the introduction of Hulu On Disney+. Bob Iger explained:

Obviously, to improve churn rates, it’s not just about technology, it’s about increasing engagement, and that’s where Hulu comes in, and we have — we call Hulu Star outside the United States.

But in putting basically Hulu into a Disney+ app experience, which we launched in beta in December, comes out of beta at the end of the month, we are not only increasing the volume of content that we have on the platform, but with that comes significantly more engagement. And in bundling Hulu with Disney+, we’re finding wherever we bundle churn rates are down significantly. So, that’s a path to profitability.

Additionally, we have to look at the entire go-to-market strategy really meaning to the consumer of the business. And one is we have significant distribution costs as well that we’re going to take a look at longer term, we think we can improve that, too. And of course, you have to look at your content.

Disney is set bring Hulu On Disney+ out of beta mode in the United States later this month and it’s expected eventually, Hulu will be merged into Disney+ fully, to allow more cost savings and to keep more subscribers engaged. While it might not happen overnight, we are seeing Disney bringing its platforms closer together, though it might be a while longer before they are fully merged, since Comcast still is involved in Hulu until the final valuation is decided.

The reduction in the amount of money spent on creating new original content is also helping bring the streaming service into profitability. This has recently been helped by the Hollywood strikes, which put a pause on new productions.

The days of cheap streaming services offering us a vast amount of original programming every week are sadly over, since this was never sustainable in the long term. However, Disney has the broad range of different studios including National Geographic, FX, 20th Television, ABC News and Disney Channel to create lots of new content, which is also being shared with its linear channels.

I’ve often said that Disney’s biggest problem is that its content is spread out across so many channels and streaming platforms, when compared to Netflix, where everything is just released on a single platform. It’s just a shame Disney seems to have taken so long to get to this point and still needs to make a final push to make this happen.

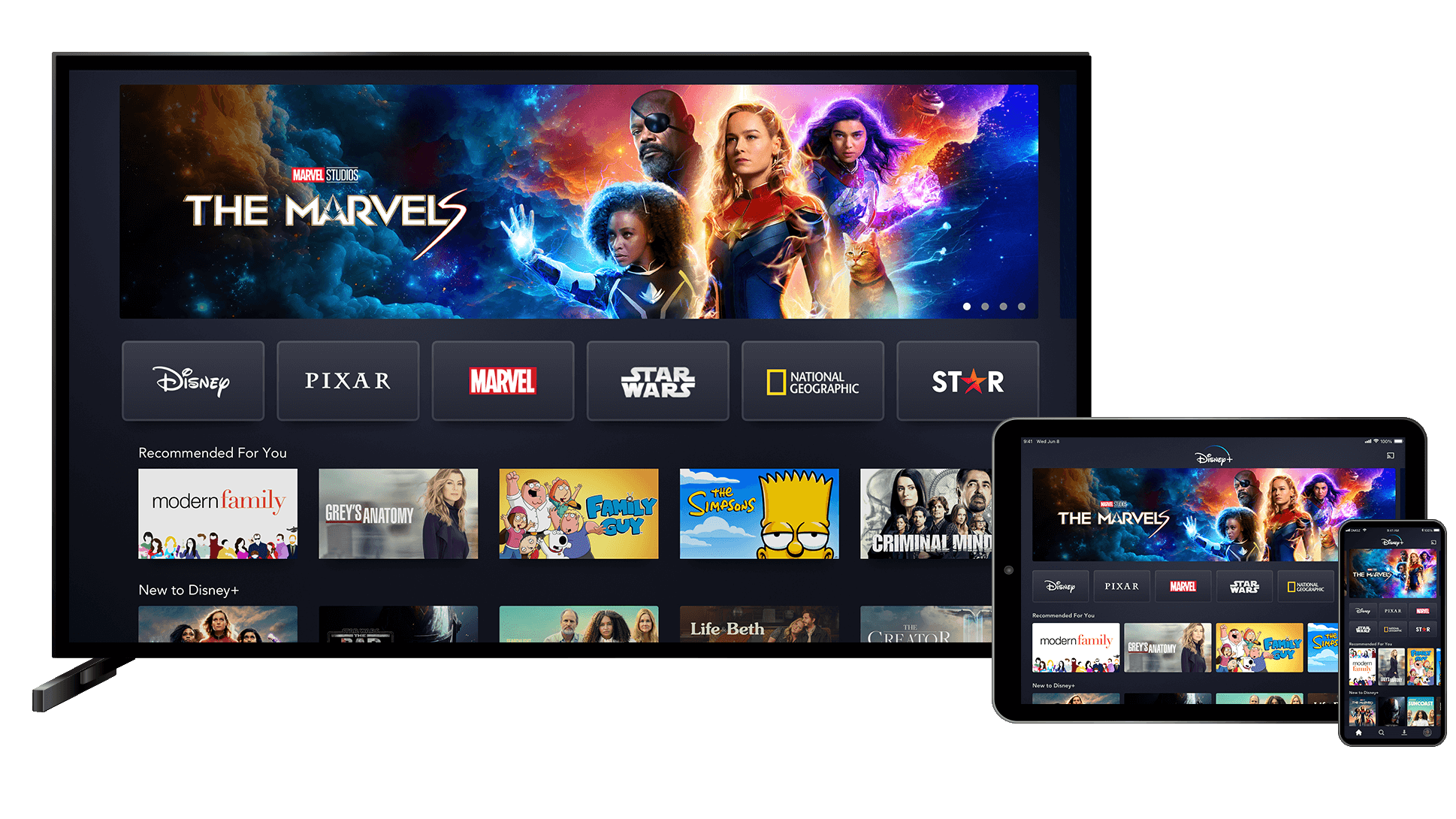

Disney has spent billions of dollars buying Bamtech, which is behind its streaming services, and building its own ad platform for use on its streaming services. However, there is little doubt that the core Disney+ app hasn’t undergone any major changes in years, while Netflix continues to get better and better.

With Disney running multiple apps, not just Disney+, Hulu and ESPN+, but they’ve also got Disney+ Hotstar, Hotstar, Disney NOW, ABC, and others, all of which is taking resources away from Disney+. To fully compete, Disney really needs to focus on its core apps. And this also impacts internationally, while most of Disney’s content is only available within Disney+, the marketing can’t fully operate on a global scale, due to Disney operating four different streaming platforms globally, compared to Netflix’s one!

Ultimately, Disney+ needs to be profitable for it to not just survive but thrive, and hopefully, it looks like it’s going to hit its first major target.

Do you think Disney+ will hit profitability this year? Let us know on social media!