Disney & Comcast Seek Independent Advisor For Final Hulu Valuation

Last year, Disney announced that it had reached an agreement with Comcast to purchase their remaining stake in the streaming service Hulu as part of a put/call agreement that was placed in a deal between the two companies back in 2019 when Disney purchased 20th Century Fox.

At the time, Comcast, Disney and Fox each owned 30% of Hulu, with Time Warner/Warner Brothers owning the other 10%. Shortly after Disney acquired 20th Century Fox, Warner’s stake was sold, resulting in Disney having 66.6% of the streaming service and Comcast had the other 33%.

As part of the agreement, in 2024, Comcast or Disney could force Disney to buy out Comcast’s stake, for a fair market value, which would be a minimum of $27.5 billion.

When the two companies agreed to the deal, they began a valuation process for Hulu to determine how much Disney would have to pay. The valuation will be assessed as of September 30th 2024, with both companies hiring different companies to value Hulu, with Disney hiring JP Morgan and Comcast hiring Morgan Stanley.

Should their valuations be more than 10% apart, a third independent party would calculate the value of Hulu, and that would determine how much Disney would have to pay.

Disney has previously estimated that it would pay Comcast approximately $8.61 billion for its share in Hulu, based on the $27.5 billion guaranteed floor value for Hulu that was set when the companies entered into their agreement in 2019 minus the anticipated outstanding capital call contributions payable by NBCU to Disney, which could reduce how much of Hulu Comcast own, down to a minimum of 21%.

According to Reuters, JP Morgan has valued Hulu at $27.5 billion, while Morgan Stanley has valued Hulu at more than $40 billion, which is why the third party valuation is now going to set how much Disney has to pay Comcast. Part of the deal between the two companies was that if the valuations had been within 10% of one another, they would have averaged out the cost between the two prices.

Over the years, there has been plenty of back and forth between the two companies, with Comcast disputing Disney’s international plans for Hulu being abandoned as instead, the Star hub was launched on Disney+ around the world instead. Eventually, the two companies agreed to end their partnership a little earlier so they could both move on.

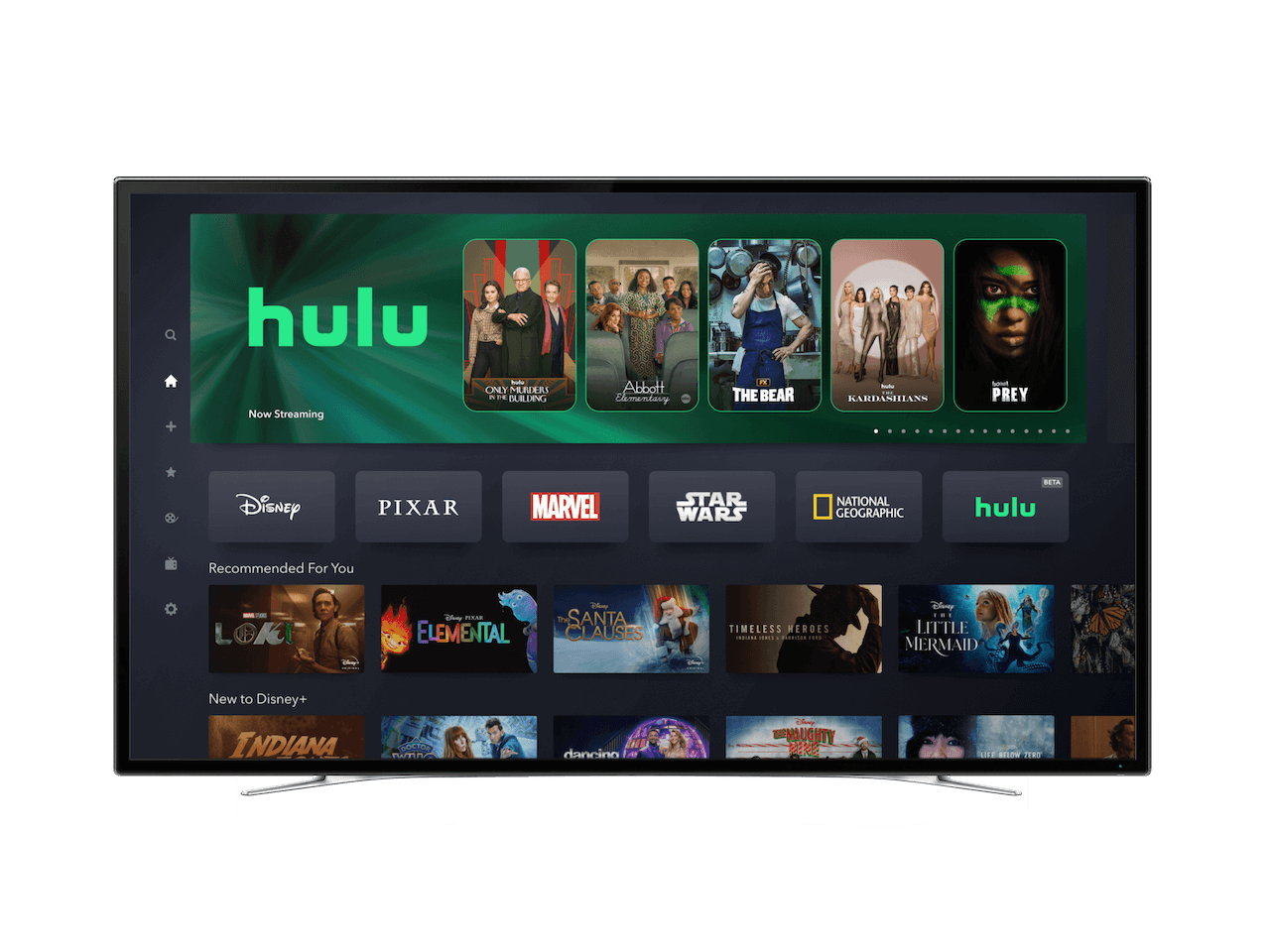

Comcast wants to use the cash to help its own business, while Disney is planning on making the final stages of making Hulu part of Disney+ to help compete fully with Netflix and Amazon Prime Video.

As you might expect, both companies have two different valuations for Hulu, with Comcast naturally wanting as much money as possible, while Disney wants to pay the minimum it needs to, hence why their contract had a fair independent valuation process built in.

Comcast has always stated that Hulu is far more valuable and would be a unique opportunity if it ever went on the public market for sale, while Disney has always underplayed that since if you remove the Disney Bundle and Disney-owned content, the value is much less.

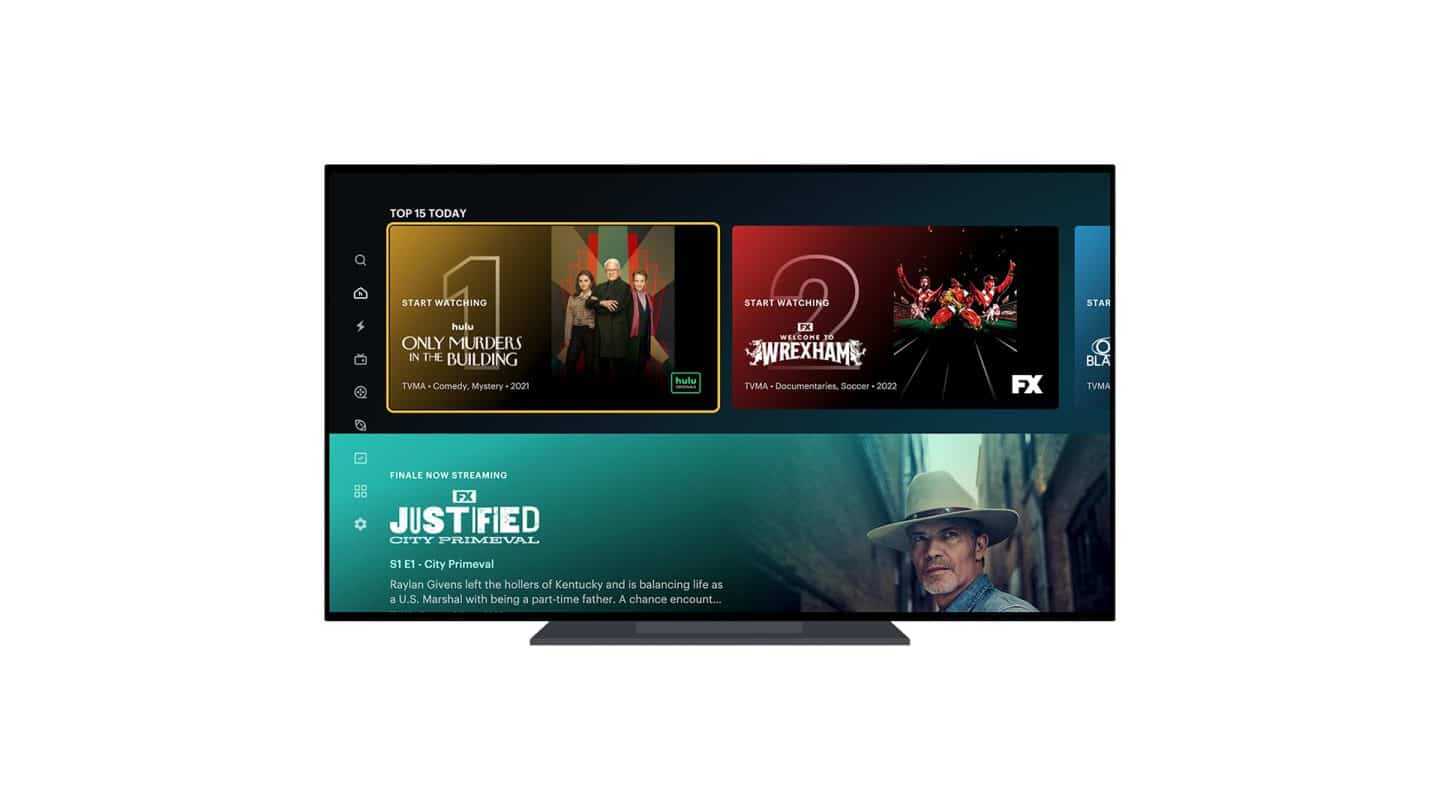

Shortly after the announcement of the deal to end the co-ownership, we saw Hulu On Disney+ launch in beta, before officially launching in March, but until Disney has fully completed its purchase from Comcast, it’s still unable to utilise the value of Hulu. While Disney has been promoting Hulu On Disney+ as part of the bundle, it still hasn’t fully incorporated everything into it.

I do believe that, eventually, Disney will merge Hulu into Disney+ to work similarly to how Disney+ works internationally, which would drastically reduce its costs, such as in terms of technology, marketing, and programming. I wouldn’t be surprised if the Star Hub internationally is also eventually renamed to Hulu, to unify how Disney+ operates globally. But again, none of this can happen fully until Comcast is no longer a co-owner.

Ultimately, should the valuation of Hulu be closer to $40 billion, Comcast could, in theory, get $13.2 billion for its share, should it be determined they still own 33%. However, if the valuation is the lowest price of $27.5 billion and Comcast’s stake is valued at around 21%, Disney might only need to pay $5.75 billion. So you can see why both companies will want the valuation to go in their favor. Either way, Disney is on the line to spend billions to acquire the final piece of Hulu, and it is just more expense that has come from the purchase of 20th Century Fox.

Roger’s POV: Hopefully, the two companies can get this third-party final valuation done quickly (if it’s not already been in place), so Comcast can move on and, more importantly, allow Disney to take full advantage of Hulu within Disney+. The consolation within the streaming industry clearly shows Disney+ needed the Hulu content to compete, and studios running multiple streaming services, split audiences and cost more money. Fully merging them might finally be possible, and it has been a long time coming. It does feel like Disney hasn’t been fully able to go all in on streaming, while Hulu was still partially owned by Comcast. But either way, it goes, I wouldn’t be surprised if the valuation is somewhere in between, but more than likely on the lower side.

How much do you think Disney will pay Comcast for Hulu? Let us know on social media!