Wells Fargo Analayst Suggests Disney Sell ESPN

With stocks in the Walt Disney Company trading well under $100 and losses within the company hitting over a billion dollars, just from the streaming division. This resulted in Bob Chapek being removed as the CEO of the company, with Bob Iger returning to the company to sort out not just the streaming division but the whole company as a whole.

The job of rebuilding Disney after the events of the pandemic, which saw Disney closing down its theme parks, cruise line and also being hit with a closure of the theatrical, plus a massive investment in purchasing 20th Century Fox and moving the company to streaming, while linear networks continue to decline. This isn’t going to be easy, and there are many theories about what Bob Iger is going to do to fix these problems.

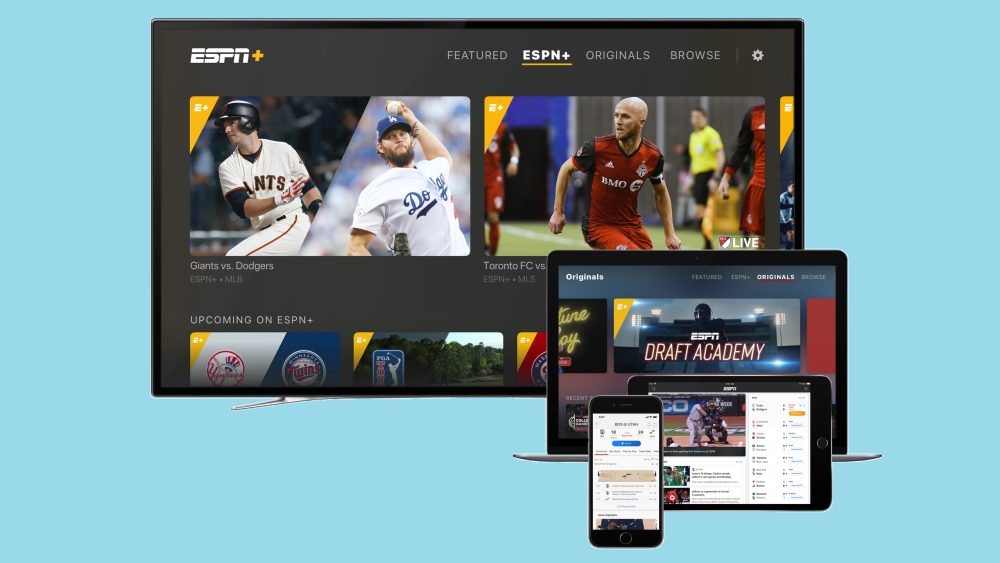

Recently, Wells Fargo analyst Steven Cahall shared a report, indicating that Disney needs to look to sell off some of its assets, including ESPN, to refocus on its core businesses.

“We think Bob Iger is returning to Disney to make big changes. Spinning [off] ESPN/ABC is the best path forward, and we see it as a reasonably probable late-’23 event.”

However, over the longer term, we expect a deeper think on portfolio reshaping. Recall that Iger built Disney into what it is today: a franchise IP leader with global scale. ESPN, traditionally the cash cow, is neither owned-IP nor global the way the rest of Disney is. With linear and sports trends diverging from core IP, we think severing the company is increasingly logical.”

Separating ESPN and ABC “would leave remaining Disney as an attractive pureplay IP company. We also think investors are increasingly put off by trying to determine how fast linear networks — most of which is ESPN/ABC — is declining as direct-to-consumer (DTC) profits improve. The seesaw creates a constant headache. Spinning ESPN/ABC provides price discovery for the asset at a Fox-esque multiple of 6-7 times enterprise value/earnings before interest, taxes, depreciation and amortization (EBITDA), and then lets remaining Disney be more of a pureplay on global IP and streaming.”

Former Disney CEO Bob Chapek was very bullish on ESPN as part of the Disney brand, looking to expand its footprint to include more revenue from gambling, but will Bob Iger be looking to sell off the sports networks? Sports are one of the most watched things on both linear and streaming. However, studios like Disney don’t own the footage, so investing billions of dollars in sports rights, which they don’t own, could be seen as an issue. And Disney might also have an issue going more into gambling, something it’s been very much against, which is why there are no casinos at its resorts or cruise ships.

Linear networks continue to lose viewers year on year, this isn’t anything new, and Disney has already begun cutting its linear networks around the world, closing down hundreds of channels, but this hasn’t really impacted on the US market yet. Bob Iger’s history with ABC might make this less likely, but linear television networks are making the company less money each year, as more people move to streaming.

Other suggestions from Steven include considering a Hulu sale to shore up the balance sheet and assuage fears from debt rating agencies. Internationally, the majority of Hulu content is already available within Disney+, which has seen huge growth and redued churn, as Disney+ offers content for the entire family, while the US version has much more limited appeal due to a lack of general entertainment content to combat other streaming services like Netflix, Paramount+ or Amazon Video.

Steven’s report was also commented on by CNBC David Faber:

“Again, just cause it’s a paper from an analyst doesn’t mean in any way that it’s something Iger is thinking about seriously. Just don’t know, but by the way, if they are, they’ll also be some potential buyers then; you may not want to just spin that thing cold.”

With stock analysts, it’s important to note, that they are interested only in improving the value of stock to make money. They aren’t looking at the long-term issues or how things impact on a consumer. In general, most stocks, especially those in the media industries, are generally down on where they used to be, so it’s not only Disney dealing with issues.

Earlier this year, activist hedge fund Third Point’s Daniel Loeb, said that he wanted Disney to sell off ESPN as well.

“a strong case can be made that the ESPN business should be spun off to shareholders with an appropriate debt load”

Spinning off or selling ESPN could be one way for Disney to reduce its debt, but its a very complicated issue.

Do you think Disney should sell ESPN? Let us know on social media?

Source – THR