Nelson Peltz Wants To Merge Disney+ & Hulu + Close Disney+ Down In More Countries

Next month, on April 3rd 2024. Disney will be hosting its annual shareholder meeting, and the executives at the company are currently trying to fend off two activist investor companies from getting onto the board of directors.

One of those activist investors is Nelson Peltz and his Trian board, which owns billions of dollars worth of stock and is trying to get other Disney shareholders to vote for them on the board.

Nelson Peltz’s group has published a 130-page whitepaper, where it has Disney’s current board of directors as “the root cause of Disney’s underperformance” in recent years.

Throughout the whitepaper, Trian points out how Disney’s spending and strategy on building Disney+ have been flawed and hasn’t yet reached its full potential. They point out many of the issues, such as how the deal Disney has had with Hulu has caused many of the problems due to the process being delayed.

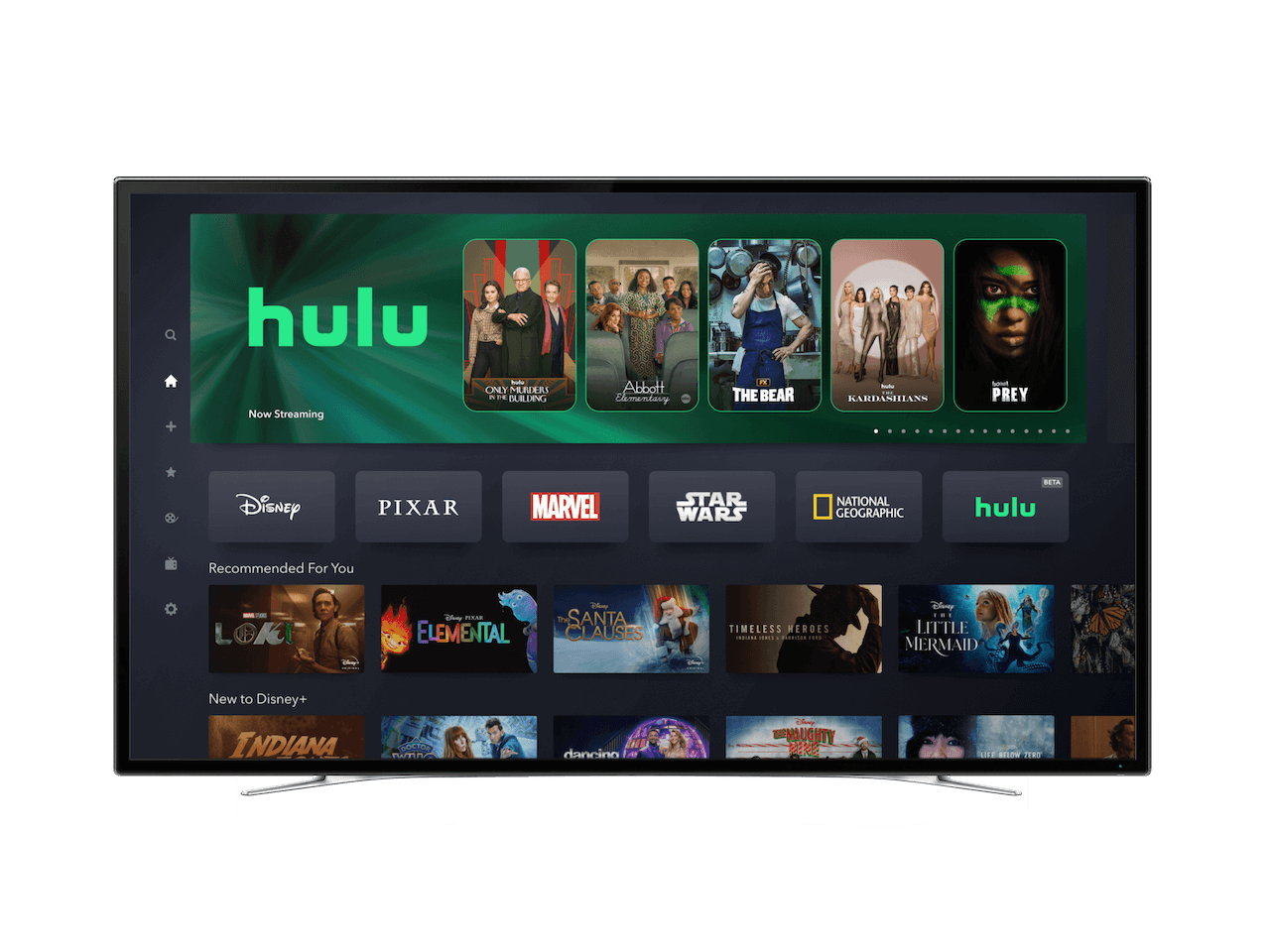

Trian has laid out some of its plans for how it would want to tackle making Disney+ more profitable, which includes phasing out the Hulu brand completely and that they are sceptical that keeping Disney’s best general entertainment content behind a Hulu tile optimises user engagement.

They also want to fully integrate Disney+ and Hulu into a product that would drive engagement by improving the UI/UX, aiding discovery, and better leveraging recommendation engines.

This past December, Disney launched Hulu On Disney+ in beta mode and is planning on launching it fully later this month, but no other details have been revealed, and it does seem like the eventual plan is to merge Hulu into Disney+, once it’s completed its purchase from Comcast, since the deal hasn’t completely been finalised, which is why it hasn’t happened yet. As internationally most of Hulu’s content is located in the Star hub, and later this summer in Latin America, Star+ will merge into Disney+ to consolidate its streaming platforms.

Trian believes that by consolidating Hulu and Disney+ into one product and organisation, Disney may improve per-subscriber unit economics and realise cost efficiencies that Wall Street research analysts estimate could amount to ~$1 billion.

Unsurprisingly, these are some of Trian’s suggestions of merging Hulu into Disney+ since it has made sense for years but had their hands tied due to the deal made with Comcast. Internationally, it’s already working, and Disney+ in the US has been starved of general entertainment because it all was sent to Hulu. Most people would agree that operating one streaming service instead of two, makes more sense and would save them money, but unfortunately, Disney has been very slow to make these changes.

Another thing Trian would like to get Disney to do, is to take more “shots on goals” and increase creative risks outside of its core franchises, similar to Netflix – explore allocating more budget dollars across lower-cost, easier-to-produce projects to further balance Disney’s higher-cost franchise content; prioritising “retention” content spend should diversify away the risk of expensive streaming flops.

There is no doubt that over the past few years, Disney+ original content has been way too dependent on franchises and has spent a fortune on creating lots of flops. Its creative output has struggled, and that’s also impacted the theatrical business. Disney is taking steps to repair this, and it’s straightforward to say Disney should make better content, but that will take time to fix.

Trian also wants to address Hulu+Live TV and believes that the capital and resources used to support Hulu Live could be better used to improve the Hulu SVOD service. Or to use Hulu Live to create an even “skinnier” bundle by dropping certain

networks from programmers who “cheat” distributors like Hulu Live by putting their best content onto their own streaming services; this would reduce costs to consumers and Disney.

Hulu+Live TV also seems like a business that isn’t going to grow as more and more people cut the cord, plus the new sports streaming service with Fox and Warner Brothers Discovery feels like a similar product. However, this could also be Disney’s plan to help shift people away from Hulu+Live TV, but it possibly isn’t something Disney wants to talk about just weeks after the initial announcement.

Another area that Trian wants to look at is whether Disney+ should be operating in 150+ countries since it adds cost and complexity to the organisation that weighs on profits, as each country typically requires its own local content rules and regulations, production requirements, foreign exchange complications, and cybersecurity & technology risks.

Trian also believes that Disney should consider adopting wholesale or content licensing strategies in select markets with structurally challenged unit economics.

Last year, Disney CEO Bob Iger spoke about how Disney+ might not operate in every country and that not all countries are equal. Only last week did Disney announce it had agreed to a major deal with Reliance and Viacom18 to create a joint venture that would combine Disney+ Hotstar with JioCinema. Disney is also licensing out its content in many countries around the world, in addition to operating Disney+.

In some countries, operating Disney+ will likely cost more to run than others. However, simply packing up and only focusing on more profitable companies is a short-term fix and opens the doors to other streaming services like Amazon and Netflix to get a stronger foothold. Plus, just going back to basically thinking only of a domestic market is also very short-sighted, as the world is only getting smaller as the internet pulls people together.

Sports is a major issue for Disney. Trian has also suggested an alternative to launching the flagship version of a direct-to-consumer version of ESPN, which is to team up with Netflix or Amazon or even add the ESPN content into Disney+.

There are some aspects of Trian’s suggestions which are common sense. Making better content, merging Hulu into Disney+ and taking a deeper look at Hulu+Live TV makes sense. It’s also clear that the Disney board is already making these movies to improve things, but with the size of Disney, things take time to fix.

However, the good thing with activist investors like Trian is that it has given Disney a huge kick up the butt to try to solve things. When Nelson Peltz began his campaign to get on the board of directors in 2022, there were some massive changes, including Bob Chapek being replaced with Bob Iger, and significant restructuring and cost-cutting measures have been taking place ever since.

Personally, I do think Disney has been dragging its feet on Disney+ for over a year; it’s been cutting back on spending and adding less while seemingly waiting to sort the Hulu deal out with Comcast. We’re much further forward, but Disney is still very quiet with its plans. We might hear more about that in the coming weeks from the executives at Disney, to show investors that Disney has a plan.

Disney went all in on streaming when launching Disney+, and the pandemic screwed up so many plans. With everything closed, Wall Street went all in on streaming platforms, but they course corrected and demanded profits over growth. Since growing a streaming service during the pandemic when everyone was stuck at home was easy, growing afterwards is much more challenging.

I’m not convinced either of the activist investor groups is interested in Disney, its content, or its fans; they want to make more money. They’ll want to mix things up, sell assets, close down anything not making money, raise the stock price, sell up and move on. This left Disney in a worse position afterwards, and as long as they’d made their billions of dollars, they couldn’t care less.

The Disney executives have made way too many mistakes over the past few years, and many of them have been replaced, but many of Trian’s suggestions in this white paper regarding the future of streaming, are already happening. The purchase of 20th Century Fox has been a major issue as Disney hasn’t been able to take advantage of the assets and has sold most of those assets at a loss.

I’ve said for years that Disney+ will never catch up with Netflix while separating its content over so many linear and streaming platforms. There are only so many streaming services people will subscribe to and only so much money to go around.

One thing is for sure: it will be interesting to see how all of this plays out in the weeks ahead.

What do you think of the Trian whitepaper plans? Let us know on social media!