Disney Highlights How Streaming Has Disrupted Their Linear & Theatrical Businesses

Disney has released a new filing with the U.S. Securities and Exchange Commission (SEC) ahead of the annual shareholders meeting next month and its ongoing proxy battle with activist investors who want a place on the board of directors.

As part of the filing, Disney outlined some of its strategies and plans for shareholder value creation, which included an entire slide dedicated to its streaming business, which includes Disney+ and Hulu.

According to Disney, “Streaming has disrupted the industry’s historic economic model”, as consumption habits have dramatically shifted, stating:

TV and streaming consumption habits dramatically shifted

- Streaming consumption is projected to nearly double from 2019 to 2027, primarily at the expense of linear

- Audiences want the flexibility to decide what, when, and how they watch

- Ad-free offerings have conditioned consumers to reduced ad loads

The pay TV ecosystem continues to decline at an accelerated rate

- Streaming provides lower price points, more flexibility, and personalization that Pay TV cannot match

TV & streaming consumption (avg daily hrs) - Significant cord-cutting has permanently impaired the legacy ecosystem

- According to third-party research, Pay TV subscribers are forecasted to decline industry-wide by 25% from 2023 through 2027

Streaming economics vs. Pay TV

- Industry streaming losses peaked in 2022 and are expected to improve going forward

- Economics to a streaming platform owner have been less profitable than the Pay TV bundle

- Aspects of streaming that consumers prefer are at odds with maximizing economics (e.g., ease of cancellation

Evolving theatrical distribution model

- Day-and-date/accelerated streaming windows for theatrical releases conditioned consumer to “wait until it’s on streaming”

- Global box office has improved following the pandemic but remains 26% below pre-pandemic levels

$26.1 - The availability of more social, out-of-home options provides consumers additional entertainment possibilities

One key note from these bullet points is how Disney is stating that the shift to streaming is causing major problems for both its linear television and theatrical business, especially with the idea that they’ve “trained” audiences to expect films to arrive on Disney+ quicker, which is why we are seeing Disney holding back some titles from arriving on their platforms until much later than the did during the pandemic, to get audiences back into cinemas.

Ever since Disney+ launched in 2019, the company has set out to make sure Disney+ is profitable by the end of 2024, and Disney is planning on achieving this through the following steps:

- Global scale and broad consumer reach, which are required for success in today’s marketplace

- Ability to create enduring franchises with unmatched longevity and unique monetization

- Best-in-class streaming platforms now on the cusp of achieving profitability

- Strong balance sheet with significant capacity for investment, M&A, and return of capital to shareholders

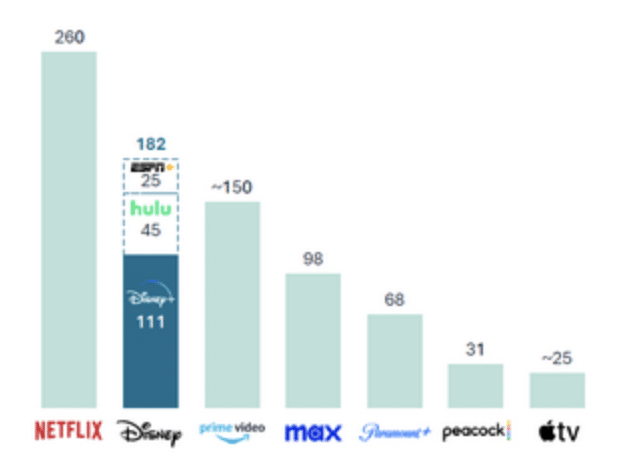

Disney has also pointed out that when its three streaming services, Disney+, Hulu, and ESPN+, are combined, they are the second largest streaming provider in the world. The company also pointed out that it has made its streaming division profitable in half the time it has taken Netflix to do so.

The executives on the board of directors have been making lots of changes to the company since Bob Iger returned as CEO after the stock price plummeted during Bob Chapek’s run as CEO. It’s been a very bumpy time since Iger’s return, and with the proxy battle being a major thorn in the side of the executives right now, they are trying to use their resources to influence shareholders to vote for them, rather than the activist investors.

There is little doubt that the activist investors have given the Disney board of directors and executives a wake-up call, that they need to do better, following floundering box office results from the past few years, becoming involved in a culture war and a huge drop in stock value from before the pandemic.

Disney has been making massive changes to its streaming business, with the launch of the Hulu On Disney+ beta following the buyout of Comcast’s stake in Hulu. This is expected to give Disney+ a huge boost in viewership and reduce the churn, as Hulu content reaches a broader audience than just Disney+ alone.

We’ve also seen Disney introduce price rises and an ad-supported tier, and it is soon going to follow Netflix’s path to clamp down on account sharing, all to help boost Disney+ into profitability. In addition to dealing with its problems in India with Disney+ Hotstar, it entered a partnership with Reliance to reduce its risks in that region.

Do you think Disney has made the right moves? Let us know on social media!