Disney To Sell Majority Stake In Star India For $3.9 Billion

When Disney purchased 20th Century Fox in 2019 for over $71 billion, it acquired a large number of assets, including Star India, which included over 80 linear television channels, film studios, a minority stake in the satellite TV company Tata Sky and the streaming service Hotstar.

Shortly after the launch of Disney+ in the United States, it rebranded the Indian version of Hotstar to Disney+ Hotstar and helped push the total number of Disney+ subscribers shooting up. However, Disney decided not to bid for the expensive streaming rights to the Indian Premiere Cricket League, which resulted in Disney+ Hotstar losing over 20 million subscribers, going from over 60 million to, most recently, just 37 million subscribers in India.

In the past few months, Disney has been having talks with many different businesses, including Sony, Blackstone, Sun TV and New Delhi TV, about potentially selling some or all of its assets in India, and it had been revealed before Christmas that Disney was close to reaching a deal with Reliance Industries Ltd, which is owned by Asia’s richest tycoon Mukesh Ambani.

It has been revealed by The Wall Street Journal that Disney has agreed to sell a 60% stake in Star India to Viacom18, which is a partnership between billionaire Mukesh Ambani and Bodhi Tree Systems. Ironically, Bodhi Tree is an investment fund founded by James Murdoch (whose family owns Fox) and the former Disney India chief Uday Shankar.

The deal is expected to be for around $3.9 billion, which is massively lower than what it was initially valued at in 2019 when the Murdock family owned it, when it was valued between $7 billion and $16 billion. The new deal will see Reliance Industries holding 51%, while Bohdi Tree Systems will own the other 9%, with Disney maintaining 40%. Viacom18 will pay about $1.5 billion in cash in addition to stock in return for its stake in the merged company.

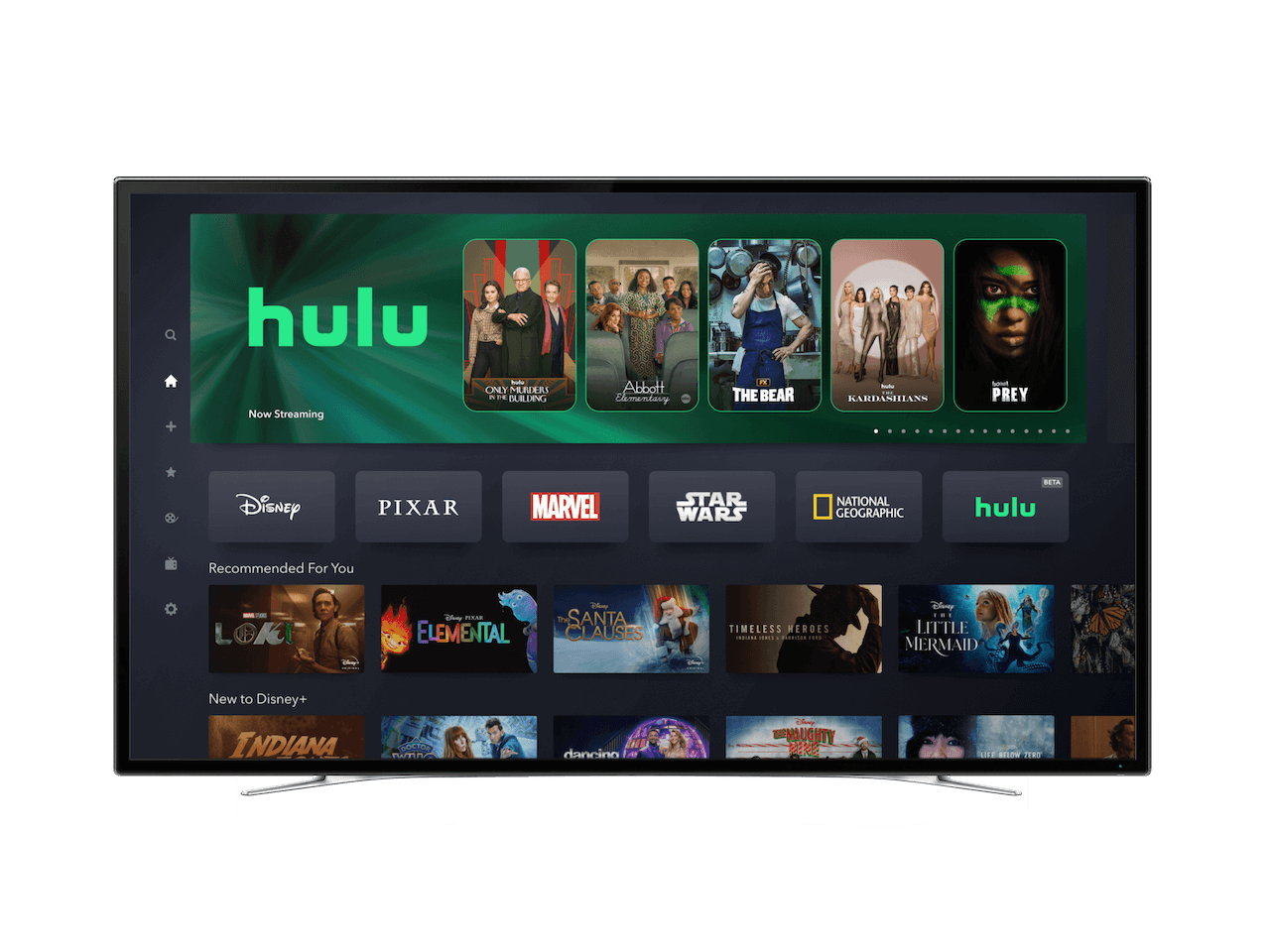

Disney has been making lots of changes to help reduce costs, with thousands of job cuts and exploring asset sales, including selling off a portion of ESPN. However, most recently, it has had to pay Comcast over $8.6 billion for the one-third stake in Hulu, so this money from Hotstar will help offset some of those costs.

With Disney maintaining a 40% stake in the merged offering between Viacom18 and Star India, it will keep operating within the region, but with partners who better understand operating within the region.

Disney has been unable to work out a strategy for India, as customers have resisted paying for streaming services and with the high costs of cricket rights, plus making content in multiple languages, the company hasn’t been able to adapt to the Indian market. The big issue that Disney has faced with Disney+ Hotstar is that each subscriber brings in only around 70 cents per month, compared to an average of $7 per month in other regions. Making it difficult for Disney+ Hotstar to become profitable.

Most recently, Zee informed Disney that it wouldn’t be able to make a payment for over a billion dollars for the TV rights to cricket rights, making things even more difficult for Disney in the region. Bob Iger has previously hinted that Disney+ might not operate in every country and that not all countries are equal.

It’s unclear what the future will bring for Disney+ Hotstar and the Hotstar and Star brands. We will likely see Disney+ Hotstar and Jiocinema merge in India, as previous reports indicated that Disney was going to do a five-year licensing deal with the new company for its Disney+ content.

Internationally, Hotstar still operates as a separate streaming service in many countries, including the UK and Canada, though the Hotstar content was merged into Hulu a couple of years ago. But most noticeably, when Hulu On Disney+ launched, the Hotstar branded content wasn’t made available.

It’s also unclear what Disney might do with the Star branding, which it uses as its general entertainment hub on Disney+ in many countries around the world. Disney has already announced that it will be merging its Latin American streaming service, Star+, into Disney+ later this year. It wouldn’t be a huge surprise to see the Star hub rebranded to Hulu now that Disney has full ownership of the brand, and it will allow a more unified brand for its general entertainment hub globally.

There are also questions about what might happen to Disney+ Hotstar in other countries in Southeast Asia like Indonesia, Malaysia and Thailand, though it’s likely the app could simply be rebranded to Disney+ like it is elsewhere.

More details on the sale are expected to be revealed soon, as the deal apparently hasn’t yet been signed. But it continues to show how Disney massively overpaid for the 20th Century Fox assets and hasn’t been able to utilise them. Hopefully, we will get more clarity on what’s going to be happening in the future soon.

What do you think is going to happen to Disney+ Hotstar and the Hotstar/Star brand? Let us know on social media!